Social Security Must Be Protected and Kept Strong

AARP is fighting to keep Social Security strong for you, your family and future generations

More than a hundred thousand Alaskans receive Social Security they've earned through a lifetime of hard work. About one in seven Alaska residents — 107,982 people — receives Social Security. These payments inject more than $1.7 billion into the state’s economy every year.

Social Security is a guaranteed source of income you’ve earned by paying into the program that helps provide financial security in retirement. For most older Alaskans, Social Security is their only reliable inflation-protected income source which helps them keep up with rising prices. What’s more, you can’t outlive the payments.

So it’s no surprise that an overwhelming majority of the public supports the program – and that endorsement crosses party and geographical lines. An AARP survey in 2020 found support for Social Security greater than 90 percent among Democrats, Republicans, and Independents.

For most retirees, Social Security is their largest source of income. The average retired worker payment in Alaska is now $1,614 a month, reflecting the 8.7 percent cost-of-living adjustment that took effect in January of 2023.

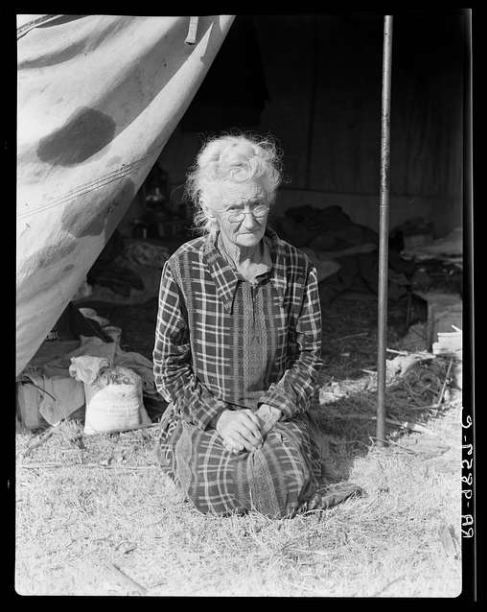

It’s hard to overstate the impact of Social Security. Before its creation in 1935, it’s estimated that roughly half of seniors without income and savings lived in poverty, dependent on family or the poorhouse, a horrific institution where residents lived in squalor and were known as inmates. Social Security addressed this injustice by recognizing that certain changes in life – retirement, illness, injury, and death – can cause a family’s income to plunge through no fault of their own.

From the start, Social Security has always been linked to work. You earn Social Security by working and contributing to the program for a period of years. Most of the U.S. workforce is now covered by the program, which is largely financed by workers’ payroll taxes. This is different from other programs that are supported by general tax revenues and pay benefits only to certain individuals.

Over time, Social Security expanded its safeguards for what Franklin Delano Roosevelt called “the hazards and vicissitudes of life.” Reflecting its social insurance mission, recipient categories were added for spouses of workers and retirees, survivors of workers who die, workers with disabilities, and their immediate family members. Today more than 66 million Americans of all ages receive Social Security.

Another distinctive trait of Social Security is that your payments are guaranteed. They don’t rise and fall with the stock market or depend on your employers’ decisions. Social Security payments are calculated based on your highest 35 years of earnings and your age when you or your dependent starts collecting Social Security.

In the 1970s, Congress took the significant step of making inflation protection a regular feature of Social Security by adding a cost-of-living adjustment. For example, this year’s “COLA” increased benefits $146 per month for the average retiree.

For all these reasons, Social Security stands out as a great and popular success. Data from the Social Security Administration tell this story quite clearly:

Who Receives Social Security Benefits in Alaska:

- Retirees: The largest group of recipients in Alaska are its 79,077 retired workers, who account for 73.2 percent of all Social Security recipients in the state.

- People with disabilities: Alaska has 11,362 residents who receive Social Security disability income, representing 10.5 percent of the state’s Social Security recipients.

- Spouses and survivors: In Alaska, 8,656 spouses, former spouses, widows, widowers, and parents of deceased recipients account for 8 percent of the state’s Social Security recipients.

- Children: An additional 8,887 children, representing 8.2 percent of the state’s Social Security recipients, receive income.

Positive Impact of Social Security in Alaska:

- Economic engine: Annual Social Security payments to Alaskans pump at least $1.7 billion into the state economy, with $1.3 billion paid annually to those receiving retirement payments and their eligible family members, $200 million via survivors payments, and an additional $200 million paid through the disability program. Recipients buy goods and services with their Social Security income, increasing business sales—which help not only the companies making those sales but also the firms that supply them. The result is more jobs and income to businesses and workers in Alaska.

- Reduced poverty: Social Security lifted 23,000 Alaskans 65 or older out of poverty from 2018 through 2020. In fact, 29.4 percent of the state’s residents in this age group would be in poverty but for Social Security; that number falls to 6.4 percent when Social Security income is included. Nationally, the program lifted 16.1 million people 65 and older out of poverty.

Who Relies on Social Security in Alaska:

- At least half of income: 29,922 Alaska residents, or 32 percent of individuals 65 and older, live in families that rely on Social Security for at least half of their income.

- More than 90% of income: 11,221 Alaska residents, or 12 percent of individuals 65 and older, live in families that rely on Social Security for at least 90 percent of their income.

- Black individuals rely more on Social Security income. Overall, 27 percent of Black Alaska residents 65 and older live in families that rely on Social for at least 90 percent of their income as compared with 10 percent of white residents.

Download a Social Security in Alaska fact sheet here >>

Of course, our society has changed a great deal since Social Security’s birth in the Great Depression. Yet by some measures, the program is becoming even more important in the 21st century.

Increased longevity keeps adding to the cost of retirement. Prices for basic necessities continue to rise. Many Americans have little or no savings, and employer-paid pensions are increasingly scarce. More seniors are single and lack family support.

Given these realities, we must keep Social Security strong. Social Security is income you have earned and can depend on, and this is as important and relevant as ever. We need to give young people the confidence that they will receive the Social Security that they’re earning now through their hard work, just as their parents and grandparents have done.

Social Security has never missed a payment and AARP will never stop fighting to protect this indispensable earned income, so it stays strong for you, your family and future generations of Americans.

More Social Security Resources from AARP

- Social Security Resource Center

- State-Specific Fact Sheets: The Importance of Social Security

- Social Security Calculator: When to apply for benefits

- On-Demand Video Learning Series: How much do you know about Social Security?

- Ask the Expert tool: Have questions on Social Security? Submit your questions here.

- 9 Ways to Strengthen Social Security