AARP Eye Center

Retired Georgia Duo Use Law Enforcement Savvy to Fight Fraud

Joe Gavalis and Dan Flynn each spent their careers in law enforcement going after hard-core criminals, including some in organized crime. Now retirees, the two Georgians are using their combined 75-plus years of experience to take on elder abuse.

The two volunteer with the North Georgia Elder Abuse Task Force Foundation, a nonprofit started in 2018 that brings together law enforcement leaders, prosecutors, public health professionals, government regulators and organizations that serve older Georgians.

Gavalis, 77, and Flynn, 72—who live in East Cobb and Marietta, respectively—crisscross the task force’s designated area, which covers the northern half of the state. They’ve facilitated more than 60 trainings for local law enforcement agencies on elder abuse issues, including credit card fraud and grandparent and romance scams. They often field calls from current law enforcement officials seeking guidance on a case.

“Most police officers in the state do not have the training that [it] requires to investigate financial crimes,” says Flynn, whose 48-year career included stints as the police chief in Marietta and Savannah. When they’re able to help out on an elder fraud case, he adds, “It feels wonderful.”

Through the Elder Abuse Task Force, Flynn and Gavalis work with the Georgia Attorney General’s Office to distribute consumer guides designed to educate older adults about fraud and to devise strategies to combat elder abuse, neglect and exploitation.

The two also give fraud prevention talks to older Georgians at senior centers, assisted living facilities and community and faith-based groups. Flynn estimates they’ve reached as many as 8,000 people over the years. Their audiences prefer simple tips and real cautionary tales over fancy PowerPoint presentations.

“We bring credibility because of our backgrounds,” Gavalis says.

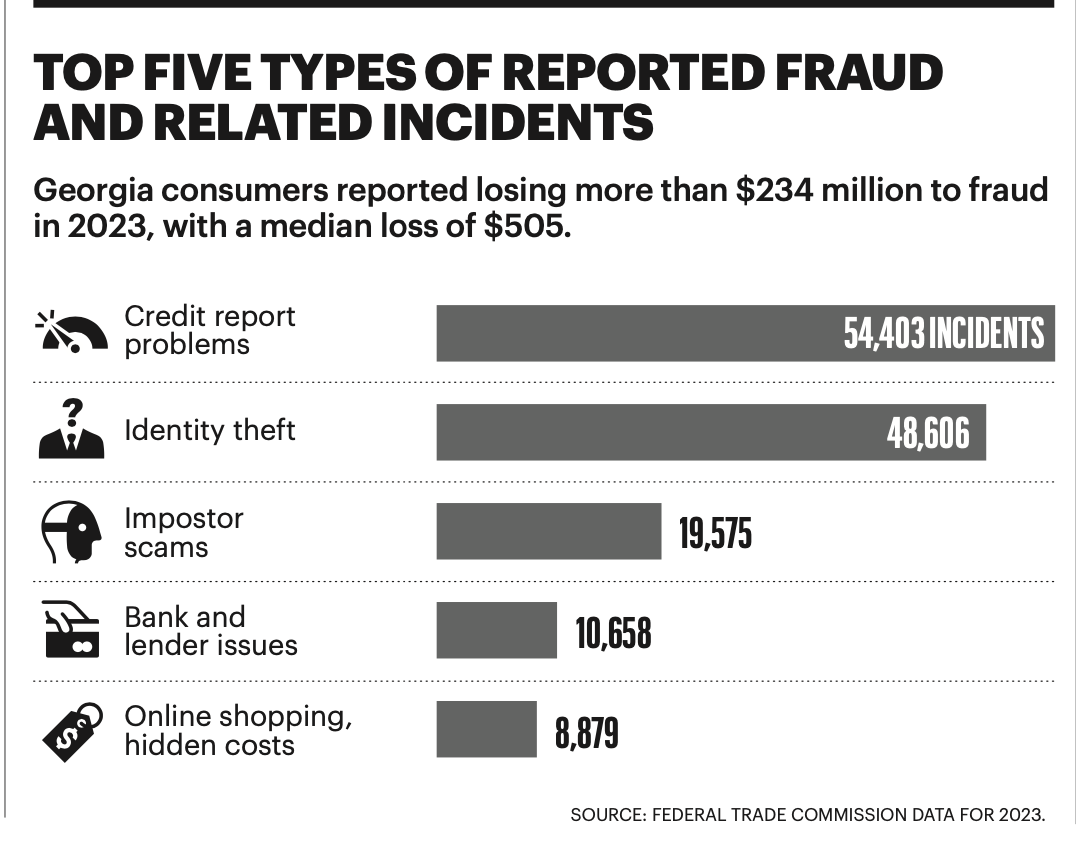

Americans reported 2.6 million incidents of fraud in 2023, with total losses of $10 billion, according to the Federal Trade Commission. Among the top types of scams: impostor schemes and fake prizes or sweepstakes.

“All of us are susceptible to fraud,” says Kathy Stokes, director of AARP fraud prevention programs. “It’s just when the older person is the victim, they lose so much more money, and so it can be catastrophic.”

Gavalis and Flynn have heard many heartbreaking stories—from people who have lost millions of dollars, to a couple who lost the last $500 they had to their name.

Many scammers are professional criminals following a script. “You think they’re next door,” Gavalis says, but they’re often in a foreign country.

That’s why it’s so important to prevent people from becoming victims in the first place. “There’s no way you can arrest all these people,” he says.

A passion to protect

After retiring in 1998 from the U.S. Department of Labor, where he investigated racketeering and organized crime involving unions and pensions, Gavalis started a forensic accounting business to help private companies ferret out financial fraud. While working for a client in California, he learned about a task force there to combat elder abuse and realized that kind of work was needed in Georgia too. In 2021, the Georgia Council on Aging honored him with its Distinguished Older Georgian Award.

Flynn’s passion for protecting older people started when he was a young officer in Miami investigating cases of theft and physical and sexual abuse against older Floridians. While he was Marietta’s police chief, he and his officers uncovered an unlicensed care home abusing six older residents and stealing their benefits. In 2014, the home’s operators pleaded guilty to false imprisonment, theft and racketeering.

He says his faith and serving others have guided him throughout his career. He retired in 2022 but felt “in my heart that I’m not done working on things to do with elder abuse,” Flynn says.

Ann Hardie spent a decade covering aging issues for The Atlanta Journal-Constitution. She has written for the Bulletin for 15 years.

More on fraud

)

.jpg?crop=true&anchor=13,195&q=80&color=ffffffff&u=lywnjt&w=2008&h=1154)