AARP Eye Center

New Program to Help Minnesotans Save for Retirement

Karin Swenson has long wanted to be able to offer some type of retirement program to her employees at the Meadow Park Preschool and Child Care Center in Rochester.

But with the tight margins in the childcare industry, it wasn’t economically feasible to do so, says Swenson, the center’s executive director.

“Half of my staff are 30 and below and I know do not have any type of retirement,” she says.

A new state-facilitated retirement savings program for Minnesota’s private-sector workers currently under development could help change that. Approved by state lawmakers in 2023, the Minnesota Secure Choice Retirement Program will allow employees who don’t have access to a retirement savings plan, such as a 401(k), at their jobs to contribute to an individual retirement account via automatic payroll deductions.

Businesses with five or more employees that don’t already offer a retirement plan must enroll workers in Secure Choice, unless the employee opts out.

The program is being launched by a board of directors that includes Erin Leonard, executive director of the Minnesota State Retirement System, as well as the head of the State Board of Investment and other experts. The retirement program board, which met together for the first time in March, plans to reach out to other states to determine best practices as they work out the details of Minnesota’s program.

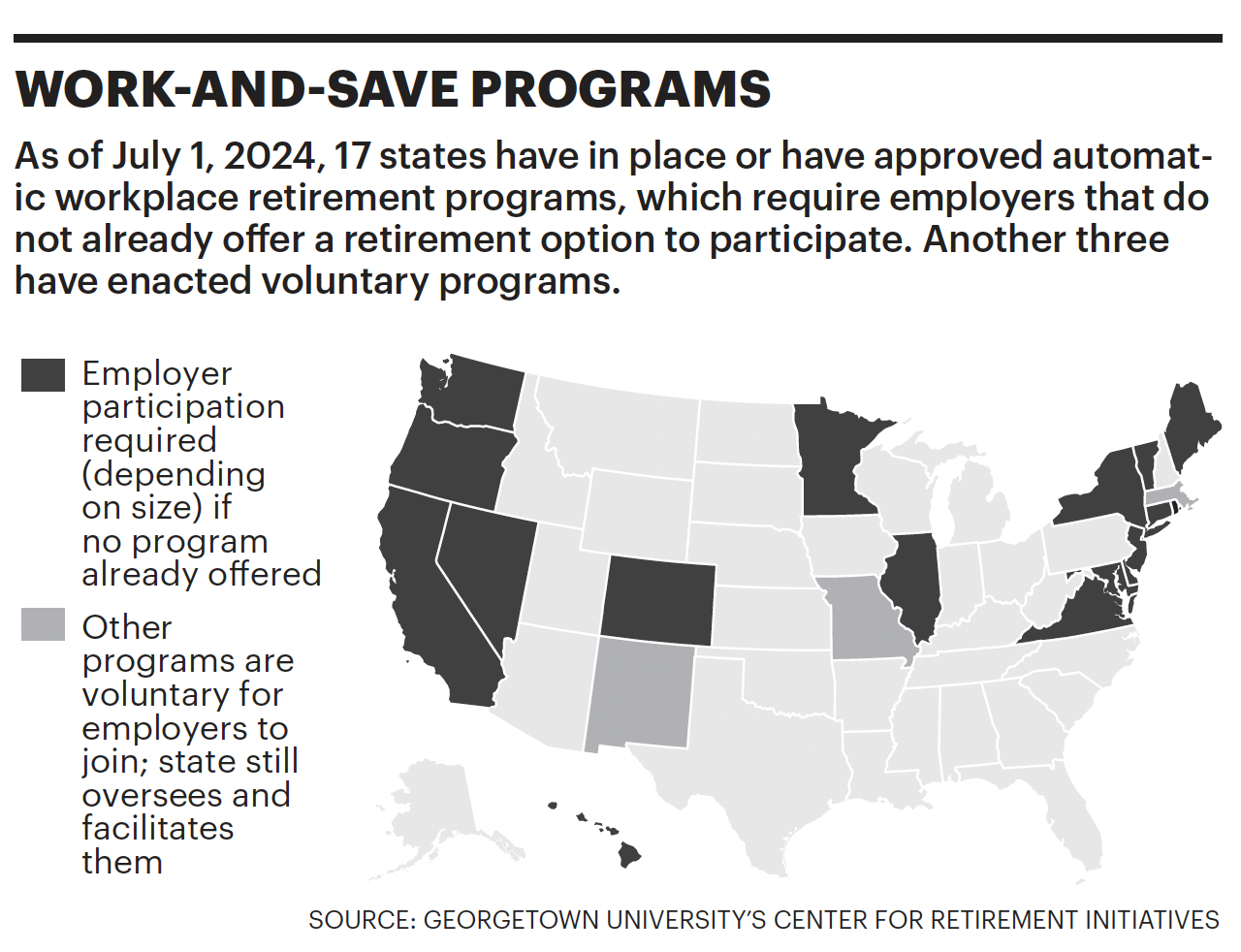

Minnesota is one of 20 states that have enacted legislation to create “work and save” programs, according to the Georgetown University Center for Retirement Initiatives. Of those, a dozen were already active and the rest were in the implementation stage.

Some states have rolled out their programs in stages based on employer size, and that’s something the board is considering, Leonard says. The board wants to make it as easy as possible for employers to participate, she notes.

The board’s duties include determining contribution rates, designating investment funds, developing a process for questions and complaints, and conducting outreach about the program.

Leonard says they “have two years to implement the program, and it will likely take almost that entire time to do so.”

Building financial security

About 32 percent of Minnesota’s private sector workers—roughly 718,000 individuals—lack access to a traditional pension or a retirement savings plan through their jobs, according to AARP Public Policy Institute research published in 2022.

The smaller the business, the less likely its employees have access to a retirement plan, the institute notes.

Secure Choice will help workers build financial security, says Mary Jo George, AARP Minnesota associate state director of advocacy. AARP advocated for the program for years.

“Both in our nation and in our state, we’re facing a retirement savings crisis,” George says.

That’s in part because of the significant decline in employer-sponsored pensions and lack of access to retirement plans on the job, she says.

Hanna Zinn, public policy manager for the Minneapolis Regional Chamber, says her organization supported Secure Choice because it’s too expensive and complicated for many small businesses to set up their own retirement plans, especially in industries where there is a lot of worker turnover or that have a lot of part-time workers.

Secure Choice gives them a way to offer access to a retirement plan, allowing them to better attract and retain talent with no added ongoing costs or risks, Zinn says. AARP is working with the chamber to host educational sessions on Secure Choice. Get details at aarp.org/mn.

Also learn more at lcpr.mn.gov/securechoice.htm. ■

Michelle Crouch is a North Carolina–based journalist who covers health care and consumer issues. She has written for the Bulletin for 10 years.

More on Retirement Savings

- How Well Are You Doing Financially?

- Climate Change Clouds Picture for Retirement Moves

- 8 Ways to Keep From Going Broke in RetirementSuze Orman on: Cash for Retirement — AARP