AARP Eye Center

New Program Aims to Help Workers Boost Retirement Savings

As president and CEO of a Mount Holly-based organization that serves people with intellectual and developmental disabilities, Jake Jones wanted to offer a retirement savings plan to help his 60 employees.

But the administrative demands and management fees weren’t feasible for a nonprofit like his.

That changed with RetireReady NJ, a new state-administered retirement savings program for private-sector workers who don’t have access to an employer-sponsored plan, such as a 401(k). The program—which rolled out statewide in July—requires organizations with 25 or more employees that don’t offer a retirement plan to register and facilitate payroll deductions for their workers.

The money goes into a traditional or Roth IRA for the employee. There is no cost to the employer. Workers can opt out or change the contribution amount at any time. Businesses with fewer than 25 workers and individuals can voluntarily participate.

Jones’ organization, ADEPT Programs, enrolled in a pilot of RetireReady NJ in the spring, and the program earned glowing reviews from his staff. “It helps them to feel like, ‘Hey this company is working to improve. They care about us,’” says Jones, 55.

AARP New Jersey worked for more than a decade to build support for and help implement the 2019 law that created RetireReady NJ. Evelyn Liebman, director of advocacy for AARP New Jersey, says the program is needed to help people age with dignity and financial security.

“Too many people are entering retirement without enough savings to provide for a decent standard of living,” she says. Research shows workers are much more likely to save for retirement if they can do it through payroll deductions, she adds.

National push to grow plans

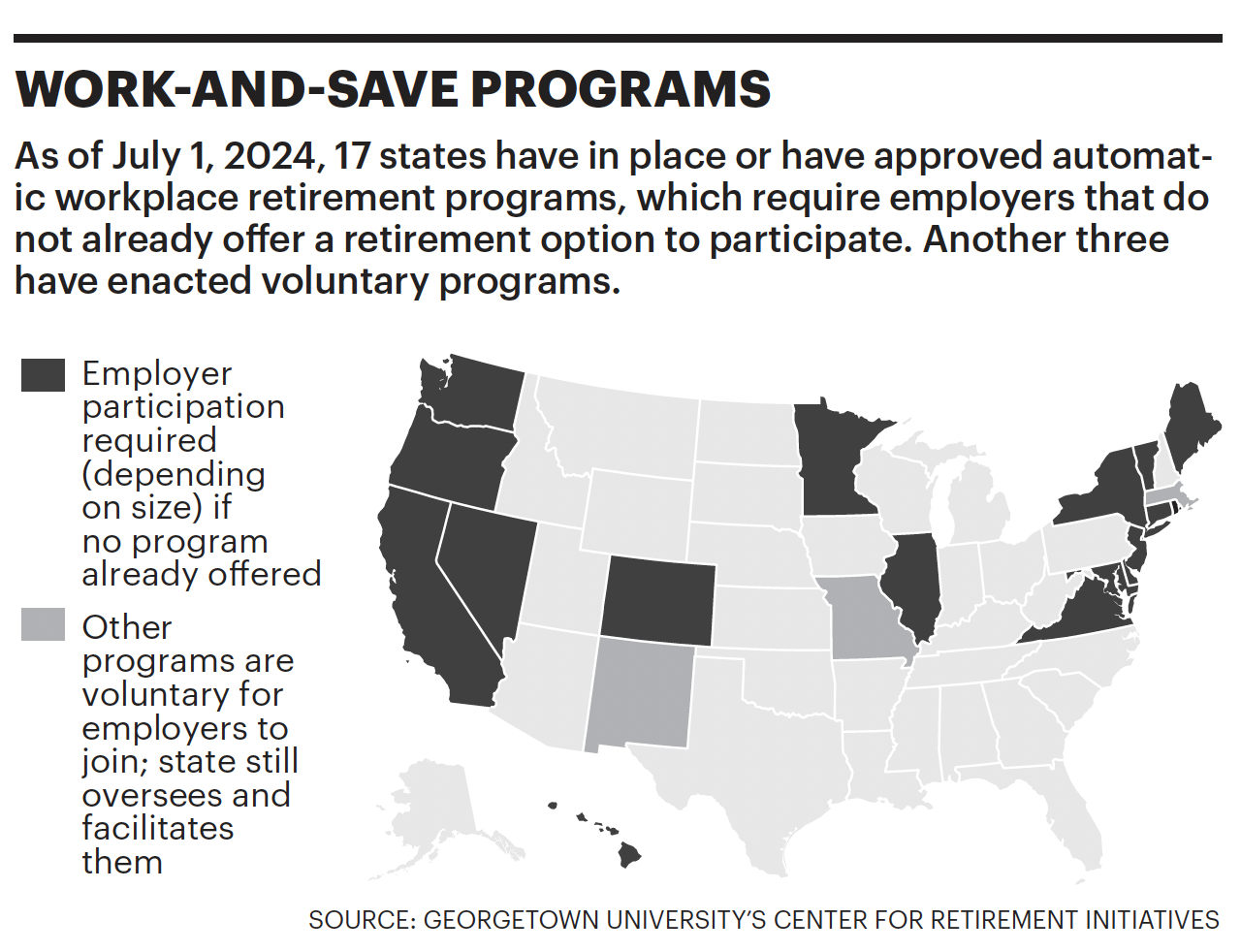

The country is facing a serious retirement crisis, Liebman says. One in 5 Americans ages 50 and older have no retirement savings, while more than half worry they won’t have enough money to last through their retirement, according to a 2024 AARP survey. Nationwide, AARP has pushed state legislators to create state-facilitated retirement savings programs, with a preference toward automatic workplace enrollment. As of July 1, 2024, 17 states already offer or have approved automatic workplace retirement programs, and another three have enacted voluntary programs.

In New Jersey, about 47 percent of private sector employees ages 18 to 64—roughly 1.5 million people—work for companies that do not offer their own retirement plan, according to 2020 research from AARP. The problem disproportionately affects those who earn $50,000 or less annually.

The data also shows that about 65 percent of Hispanic workers, 51 percent of Black workers and 41 percent of Asian American workers in the state lack access to retirement plans. Together, these workers make up more than half of New Jerseyans without access to a workplace retirement plan.

Luis O. De La Hoz, chairman of the board of New Jersey’s Hispanic chamber of commerce and a regional director of community lending for Valley Bank, says RetireReady NJ is particularly helpful for workers with low and moderate incomes. But it also helps small businesses by making them more attractive to workers.

“You will be able to compete with something that was reserved only for large companies,” he says.

Todd Hassler, executive director of the program, says it’s never too late for workers to start saving for retirement, even if they are in their 60s. “It may not have the same influence or amount to the same amount of money as somebody who starts at age 18 and saves consistently, but it gives you something,” he says.

In the coming months, AARP New Jersey will be conducting an education and outreach campaign to encourage more workers to participate in RetireReady NJ.

No one needs to convince Jones, who has already signed up. So has India Rochon, 33, ADEPT’s administrative service coordinator and a mother of five.

Saving for retirement is “very, very important because when you’re no longer working, you want to make sure that you’re able to still live comfortably,” Rochon says. “And sometimes ... Social Security is just not enough.” ■

Ann Hardie spent a decade covering aging issues for The Atlanta Journal-Constitution. She has written for the Bulletin for 15 years.

More on Retirement Savings

- AARP Retirement Calculator: Are You Saving Enough?

- How to Save Like a 401(k) Millionaire

- 7 Retirement Surprises and What to Do About Them

)

.jpg?crop=true&anchor=13,195&q=80&color=ffffffff&u=lywnjt&w=2008&h=1154)